Secure domestic and global bank transfers

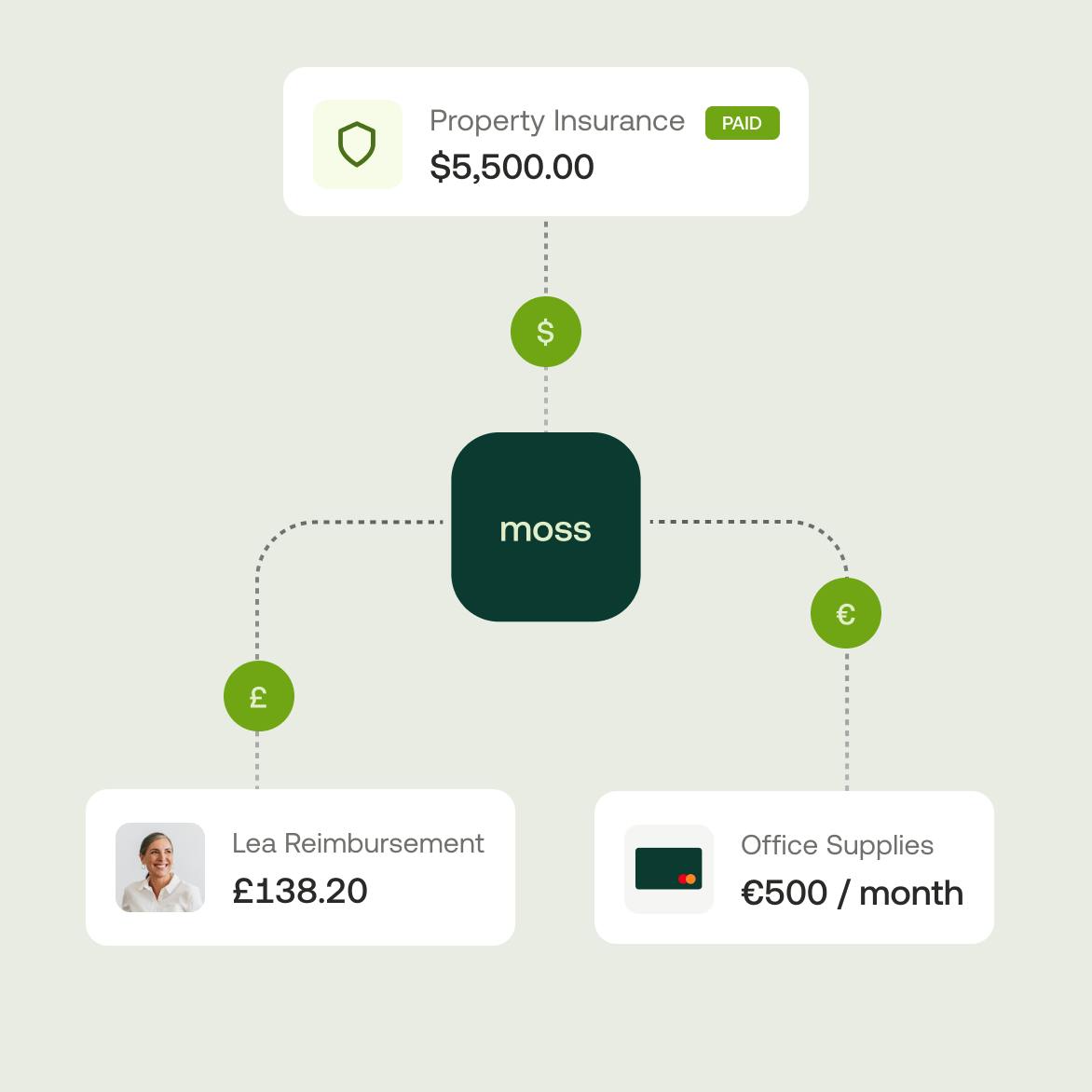

Moss enabled secure handling of supplier payments and reimbursements - all in one platform.

FCA Regulated (UK) / BaFin Regulated (EEA)

Instant domestic and global payments

Make instant and international bank transfers in 70+ currencies directly from Moss.

Pay suppliers and reimburse employees

Bank transfers integrated with your Accounts Payable and Reimbursement workflows

Secure payment controls

Built in multi-user payment authorisation and two-factor-authentication.

Trusted by finance teams at Europe's leading companies

1.

Review, approve and pay using Moss

Make bank transfers in Moss

Send instant payments in the UK via the Faster Payments network and SEPA instant transfers in 70+ currencies directly from Moss.

- Pay supplier invoices

- Reimburse employees

- Sync and reconcile payments with your accounting software

2.

Better payment runs

End-to-end payment runs

Pay with Moss prepares and executes payment runs automatically, saving time and reducing errors.

- Pre-fill payees and amounts

- Execute payments in bulk

- Transparent payment statuses

3.

Controls and workflows

Secure payments

Authorise payments securely with role-based permissions tailored to your business needs.

- Multi-user payment authorisation

- Secure two-factor authentication

- Role-based permissions

4.

Accounting reconciliation

Accurate, up-to-date accounting

Sync payment entry data with your accounting system via API or CSV to maintain accurate accounting records.

- Sync data from Moss at any time

- Match payments with invoices and reimbursement requests

Licensed e-money institution

Moss GmbH, part of the Moss group, is licensed in Germany by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) as an e-money institution. In the United Kingdom, Moss partners with regulated providers who are authorised by the Financial Conduct Authority (FCA) to deliver payment services.

Safeguarding your funds

Funds are securely held in safeguarding accounts with Deutsche Bank in the EEA, and Barclays Bank and the Bank of England in the UK.

Pay as you grow

Our pricing model is unique—just like your business. Design your ideal package: start with a base like Corporate Cards, Employee Reimbursements, or Accounts Payable, enhance with add-ons like Advanced Accounting or ERP integrations, and upgrade to an integrated suite when you're ready.

Best-in-class customer service, mobile app, and all the financial integrations you need to start effectively managing your spend.

Maximise spend efficiency and control with unlimited cards, customisable limits, and automated receipt fetching.

Make submitting reimbursements quicker and easier through streamlined upload and approval, and employee payouts directly from Moss.

Streamline accounts payable flow with customisable review process, effective supplier and OCR based automation, and one-click payments.

Improve financial oversight through budget tracking, spend insights, and greater flexibility in your approval flows.

Simplify purchasing through real-time budget oversight and efficient handling of purchase requests.

Native integrations to your ERP system, including support for any controlling dimensions that your business uses.

Enhance your pre-accounting experience with AI based automation, project-specific tracking, or the setting of mandatory fields.